Startup to Scaleup marks the moment when a nimble startup pivots toward a repeatable, scalable growth engine, guided by disciplined planning, solid unit economics, and a clear path to profitability that makes ambitious goals feel achievable rather than risky. To navigate this transition, founders blend growth tactics for startups with a robust financing plan, ensuring every major milestone unlocks capital, talent, and momentum, while governance and operating discipline help protect runway and reduce the uncertainty that often accompanies rapid expansion. A practical blueprint weaves in startup to scaleup financing and financing strategies for scaleups to illustrate how capital structures evolve as revenue, margins, and retention improve, enabling a staged approach to funding that aligns investor expectations with product milestones and customer success momentum. With disciplined metrics, governance, and a scalable operating model, leaders craft a credible investor narrative that highlights controllable costs, predictable growth, and a plan to sustain profitability through expansion, all while maintaining resilience against market volatility and competitive pressure. This guide offers actionable playbooks to extend runway, attract the right partners, and build lasting value as the business matures into a scalable enterprise with a healthy balance between speed and sustainability.

Viewed through an LSI lens, the transition from an early-stage venture to a growth-focused organization centers on repeatable processes, healthier unit economics, and a capital plan that scales with demand. Investors and lenders look for clear milestones, cash flow visibility, and governance structures that adapt as revenue grows and customers expand their lifetime value. As the company matures, the emphasis shifts from rapid experimentation to durable growth engines, well-defined profitability targets, and a capital stack that preserves optionality for future rounds. Framing the topic with semantically related terms—such as startup financing evolution, scaleup growth playbooks, and strategic funding for high-growth firms—helps readers and search engines connect concepts that share common intents. Ultimately, the focus is on building a resilient business model that can weather volatility while continuing to improve margins and deliver sustainable value to customers, employees, and investors.

Startup to Scaleup Financing and Growth Tactics

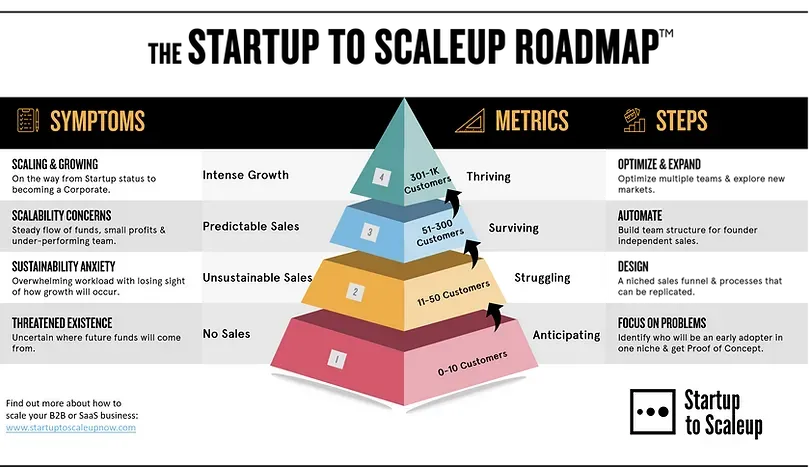

Moving from a nimble startup to a scaleup requires a deliberate approach to funding and growth. This is where startup to scaleup financing intersects with growth tactics for startups: you must align capital with milestones, build a credible revenue engine, and show investors that unit economics can scale. Key metrics like CAC vs LTV, gross margin by product line, and churn inform both the financing narrative and the go-to-market strategy, helping you justify additional rounds and runway.

Venture funding for scaleups is not just about more cash; it’s about the right mix of instruments and governance to fuel scalable growth. Consider multi-stage financing, convertible instruments or SAFEs in early rounds, debt facilities to optimize capital structure, and revenue-based financing where appropriate. A balanced approach—combining equity rounds with non-dilutive options and disciplined burn-rate management—provides runway and optionality for subsequent rounds.

Venture Funding for Scaleups: Preparation and Execution

Preparing for venture funding requires a compelling narrative, solid traction metrics, and governance readiness. Investors expect a credible path to market leadership, a clean cap table, and a plan that ties funding milestones to measurable growth in gross margins, net revenue retention, and LTV/CAC dynamics. By articulating the problem, the solution, and the scalable economics—alongside a robust revenue model—you set the stage for successful venture funding for scaleups.

Execution hinges on investor-ready materials and disciplined governance. Build a data-driven fundraising package, maintain a transparent reporting cadence, and integrate structured equity considerations and option pools into the cap table. Demonstrate a repeatable sales motion, a clear product roadmap, and a strategy for using funds to accelerate growth through partnerships, product-led expansion, and disciplined capital deployment that aligns with your financing strategies for scaleups.

Frequently Asked Questions

What is Startup to Scaleup financing and how does it align with financing strategies for scaleups?

Startup to Scaleup financing is the phased approach to funding as a company grows from an early, nimble operation into a repeatable, scalable business. It requires a diversified mix of equity rounds (seed to Series A, B, and beyond), convertible instruments to bridge rounds, debt facilities to optimize capital structure, and selective non-dilutive options like grants or revenue-based financing. The goal is to create runway aligned with a clear growth plan while preserving optionality for future rounds. Robust cash flow forecasting, disciplined burn rate management, and milestone-based fundraising reduce risk and improve leverage with investors. Metrics such as CAC/LTV, gross margin by product, churn, and net revenue retention should inform funding decisions and investor storytelling.

What are growth tactics for startups to apply on the Startup to Scaleup journey to achieve scalable growth, and how do they relate to venture funding for scaleups?

Growth tactics for startups on the Startup to Scaleup journey focus on achieving product-market fit at scale, building a scalable go-to-market engine, and expanding revenue from the existing base. Prioritize tight product-market fit, efficient customer acquisition, onboarding optimization, and a strong retention and expansion strategy to drive expansion revenue. Embrace data-driven decision making to forecast demand, measure funnel performance, and spot at-risk cohorts before problems arise. As you scale, automate key processes, invest in the right technology stack, and align teams around milestone-based growth plans. This discipline supports venture funding for scaleups, since investors want to see repeatable sales cycles, scalable customer success, and a clear path to profitability demonstrated through solid unit economics and rising net revenue retention.

| Topic | Key Points |

|---|---|

| Mindset & Readiness | Phase shift from sprint mode to orchestrated growth; readiness indicators include improving gross margins, a clear path to profitability, and a predictable revenue engine. Align capital with growth milestones. |

| Scale Metrics | CAC vs LTV, gross margin by product line, churn rate, and net revenue retention; strong, defensible metrics support a narrative of scalable growth and reduce perceived risk for investors and lenders. |

| Financing Transition | Diversified early-stage funding sources (founders, friends and family, angels, seed funds); move toward multi-stage financing that supports expansion and operating resilience; create runway that matches the growth plan while preserving optionality. |

| Startup to Scaleup Financing | Equity rounds (seed, Series A, B, and beyond) to fund growth; convertible instruments or SAFEs to bridge to a priced round; non-dilutive or low-dilution options like grants, strategic partnerships, and revenue-based financing; debt facilities and lines of credit to optimize capital structure and cash flow. |

| Growth Tactics for Startups | Tight product-market fit; efficient customer acquisition; retention and expansion with a product-led growth mindset; data-driven decision making; scalable automation and technology stack; disciplined milestones aligned with financing plan. |

| Financing Strategies for Scaleups | Structured equity and governance; debt and hybrid financing; revenue-based financing and royalties; strategic partnerships; planning for multiple rounds with contingency plans; design metrics and milestones that demonstrate sustained growth and high retention. |

| Venture Funding Preparation | Building a compelling narrative; establishing traction metrics; governance readiness; a clean cap table; milestones showing repeatable sales and a credible path to profitability; a clear use-of-funds plan and exit/return expectations for investors. |

| Operational Readiness | Scalable product development; talent strategy and culture; customer success at scale with robust onboarding and expansion motions; financial discipline including forecasting, cash flow management, and scenario planning. |

| Common Pitfalls & Best Practices | Pitfalls: overreliance on a single financing instrument; dilution traps; growth without profitability; poor data hygiene. Best practices: investor relations, milestone-based progress, and aligned incentives across leadership, employees, and investors. |

Summary

Startup to Scaleup is a balancing act between fueling growth and protecting capital. This descriptive overview synthesizes how mindset shifts, scalable metrics, diversified financing, and operational readiness come together to move from startup traction to scaleup expansion. By implementing disciplined milestones, a robust capital stack, and scalable growth tactics, startups can progress toward sustainable profitability and compelling investor value.