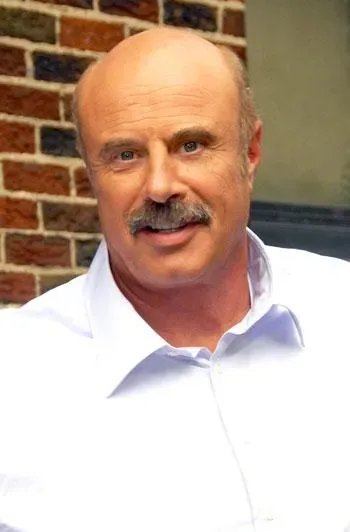

In a surprising turn of events, Dr. Phil’s bankruptcy has made headlines as Merit Street Media, the TV network he launched, seeks protection from creditors while simultaneously suing its distribution partner, Trinity Broadcasting Network (TBN). The lawsuit reveals underlying tensions between the two companies, with claims that TBN failed to honor its commitments to provide essential services and support. Despite Phil McGraw’s immense success as a talk show host, pouring $25 million into the venture over just six months, the network’s financial struggles have forced difficult decisions, including layoffs and contractual terminations. Furthermore, the significant liabilities mentioned in the Chapter 11 filing highlight the precarious position of Merit Street. As the dust settles on this high-profile case, fans of Phil McGraw are eager to learn the full implications of this TV network bankruptcy on both his career and the wider media landscape.

Recently, the entertainment world has been abuzz with news about the financial troubles facing Phil McGraw’s new television venture. This development comes in the form of a bankruptcy filing by Merit Street Media, a network that aimed to leverage McGraw’s popularity but has encountered significant challenges. In a striking legal maneuver, Merit Street seeks to hold its distribution partner, TBN, accountable for failing to deliver on critical operational support. The controversy surrounding the Merit Street bankruptcy not only reflects the difficulties of media startups but also highlights issues stemming from contractual obligations in network partnerships. As we unpack this unfolding situation, the future of McGraw’s brand and his ambitious foray into a new media landscape hangs in the balance.

Dr. Phil’s Bankruptcy: A Closer Look at Merit Street Media’s Financial Struggles

Dr. Phil McGraw’s foray into the television network business has taken a tumultuous turn as Merit Street Media files for bankruptcy. The decision to seek Chapter 11 protection marks a significant downturn for McGraw, who has enjoyed immense popularity and financial stability via his long-running talk show. The bankruptcy has not only put a spotlight on Merit Street’s operational challenges but also on the larger implications this has for McGraw’s brand and legacy. As the financial strains mount, industry analysts are closely monitoring how such setbacks will affect McGraw’s credibility and his future projects.

The bankruptcy filing lists staggering liabilities, indicating that Merit Street Media owes between $100 million and $500 million. This financial distress is compounded by the lawsuit against Trinity Broadcasting Network (TBN), the network’s distribution partner. The ongoing legal battle highlights significant operational failures, including TBN’s inability to meet agreed-upon obligations, which has severely impacted Merit Street’s ability to generate revenue. Dr. Phil’s decision to finance the network personally to the tune of $25 million raises questions about whether he can continue to support these endeavors financially while maintaining his reputation as a media personality.

The Downfall of Merit Street Media Amidst Legal Battles with TBN

The tumultuous relationship between Merit Street Media and the Trinity Broadcasting Network is at the heart of the network’s current crisis. According to the lawsuit filed by McGraw’s company, TBN has significantly failed in its contractual duties, which included providing essential production support and securing airtime across various television stations. Amidst claims of ‘comically dysfunctional’ technical services, it’s clear that TBN’s mismanagement has directly contributed to Merit Street’s operational difficulties. With equipment failures reported during live broadcasts, the reliability of Merit Street’s programming has come under fire, threatening its viability in a competitive media landscape.

As the situation unfolds, the nature of the distribution partnership has come under scrutiny. McGraw’s initial vision for Merit Street was to harness TBN’s extensive reach to penetrate the market with engaging content. However, the fallout has been tumultuous, leading to layoffs and a crippling dependency on McGraw’s financial support. This legal dispute underscores a broader narrative within the television industry regarding the risks associated with partnerships and collaborative ventures, especially in the face of financial instability.

Merit Street’s bankruptcy filing also brings to light the broader issue of TV network bankruptcy, signaling a potential trend within media companies struggling to adapt to changing viewer preferences and marketing strategies. Companies are finding it increasingly difficult to rely solely on traditional revenue streams, and with Merit Street’s reliance on its distribution partner, the operational vulnerabilities have become clear. As networks navigate this precarious environment, it raises further questions about the sustainability of new media ventures that fail to secure strong foundational partnerships.

Phil McGraw’s involvement in this lawsuit and bankruptcy highlights the significant risks associated with launching a new media enterprise. McGraw’s prominent status as a television personality has brought considerable attention to Merit Street, but this could also have negative implications as multiple job losses and financial collapse play into public perception. As McGraw aims to reclaim control over his network, industry observers are eager to see what steps he will take next, and whether he can recover from this substantial blow to his brand.

In light of these developments, it’s essential to consider how Merit Street’s fate may influence future ventures in the television industry, especially for personalities like McGraw who decide to step beyond traditional roles. The outcomes of such lawsuits, along with impending financial decisions, may serve as a cautionary tale to those in entertainment considering similar paths. Potential investors and partners will undoubtedly be watching closely to gauge the risks associated with investing in or collaborating with media figures who may experience unforeseen operational challenges.

Merit Street Media: Challenges and Opportunities Ahead

Despite the significant challenges facing Merit Street Media, there may still be avenues for recovery and growth. As the bankruptcy process unfolds, there is an opportunity for restructuring that could lead to a more viable operational model. If McGraw and his team can effectively navigate this legal and financial landscape, they may be able to reposition the network to better align with market demands. This could involve reevaluating contracts with partners like TBN or aggressively seeking new distribution channels to enhance viewership and revenue streams.

Reassessing the content strategy will also be crucial for Merit Street’s resurgence. McGraw has successfully carved a niche within the political commentary sphere with programs like ‘Dr. Phil Primetime,’ but expanding the range of content could help attract a broader audience. This might include diversifying programming to include more entertainment and lifestyle shows that appeal to various demographics while still maintaining the core values and vision of the brand. As the dust settles from the current turmoil, strategic pivots could foster renewed interest and support from advertisers and viewers alike.

Implications of the Merit Street Lawsuit on Media Partnerships

The lawsuit against Trinity Broadcasting Network has far-reaching implications not only for Merit Street Media but also for the broader landscape of media partnerships. As traditional media companies continue to struggle, the dynamics of collaborative ventures are becoming more intricate and fraught with risk. This lawsuit sheds light on how expectations and deliverables must be clearly defined and adhered to in any agreement, particularly in high-stakes situations involving large sums of capital. Stakeholders will undoubtedly reassess their approach to partnerships, learning from Merit Street’s misfortunes.

Furthermore, the legal ramifications of this case could serve as precedent for other media entities facing similar partnership challenges. The outcomes may lead to increasingly stringent regulations regarding obligations and responsibilities in partnerships, protecting companies from the kinds of operational failures experienced by Merit Street. As media consumer habits evolve, partnerships must be robust and adaptable, ensuring that all parties can meet their commitments to foster sustainable business models.

Frequently Asked Questions

What led to Dr. Phil’s bankruptcy filing with Merit Street Media?

Dr. Phil’s bankruptcy filing with Merit Street Media was prompted by severe operational issues with its distribution partner, Trinity Broadcasting Network (TBN). The lawsuit alleges that TBN failed to meet its contractual obligations, causing significant financial strain on the network and leading McGraw to personally finance $25 million over six months.

How does the Merit Street Media lawsuit relate to Dr. Phil’s bankruptcy?

The Merit Street Media lawsuit is central to Dr. Phil’s bankruptcy as it highlights the failure of TBN to provide essential services such as studio space and payment to TV distributors. These failures directly contributed to the network’s financial distress, ultimately resulting in the Chapter 11 bankruptcy filing.

What are the financial implications of Dr. Phil’s Merit Street bankruptcy?

Dr. Phil’s Merit Street bankruptcy filing reflects liabilities between $100 million and $500 million, indicating a serious financial crisis. The lawsuit further reveals that TBN’s underperformance led to significant additional costs for Merit, pushing McGraw to inject over $25 million to keep operations afloat.

What services was TBN supposed to provide for Dr. Phil’s Merit Street Media?

TBN was contracted to provide essential back-office and production services for Dr. Phil’s Merit Street Media, including studio facilities, technical support, and payment to TV distributors. The lawsuit claims TBN did not fulfill these obligations, significantly impacting Merit Street’s operations and profitability.

How did the bankruptcy of Merit Street Media impact Dr. Phil’s programming?

The bankruptcy of Merit Street Media has led to significant disruptions in Dr. Phil’s programming, including layoffs of 40 employees and the hiatus of the show ‘Dr. Phil Primetime.’ This reflects the broader operational challenges and financial struggles facing the network due to unresolved issues with TBN.

What role did Dr. Phil’s personal funding play in the bankruptcy situation?

Dr. Phil, through his company Peteski Productions, personally funded over $25 million to bail out Merit Street Media amid ongoing financial crises. This substantial investment underscores the severe impact of TBN’s failures on the network’s stability and highlights the reliance on McGraw’s financial resources.

Can Dr. Phil recover from the bankruptcy of Merit Street Media?

The future recovery of Dr. Phil and Merit Street Media after bankruptcy largely depends on the outcome of the lawsuit against TBN. If successful, it could lead to necessary funding and operational reforms, allowing the network to stabilize and recover, but significant challenges remain.

What was the impact of TBN’s failures on Dr. Phil’s Merit Street programming?

TBN’s failures caused serious operational issues for Dr. Phil’s Merit Street programming, including production delays, inadequate marketing, and financial disruptions that forced the cancellation of key deals and the layoff of staff, ultimately leading to bankruptcy.

What is the significance of the Chapter 11 bankruptcy filed by Merit Street Media?

The Chapter 11 bankruptcy filed by Merit Street Media is significant as it allows the network to reorganize under court supervision while attempting to resolve its substantial debts and contractual disputes with TBN, pivotal to determining whether the network can survive in the long term.

What challenges did Dr. Phil face in launching Merit Street Media?

Dr. Phil faced numerous challenges in launching Merit Street Media, including reliance on TBN for essential services that were not delivered, leading to operational dysfunctions and financial strain, which ultimately culminated in the network’s bankruptcy filing.

| Key Point | Details |

|---|---|

| Bankruptcy Filing | Merit Street Media, founded by Dr. Phil, filed for Chapter 11 bankruptcy protection. |

| Lawsuit Against TBN | Merit is suing its distribution partner, TBN, for failing to meet contractual obligations. |

| Financial Struggles | Dr. Phil has personally financed the venture, contributing $25 million over six months. |

| Employment Cuts | 40 employees were laid off in June 2025 due to financial difficulties. |

| Liabilities and Assets | The company’s liabilities are estimated between $100 million and $500 million. |

| Operational Challenges | The lawsuit claims TBN’s technical services were ineffective, hindering Merit’s operations. |

| Content Programming | Merit Street airs programs including ‘Dr. Phil Primetime’ and features political commentary. |

| Marketing Failures | TBN did not provide adequate marketing support as promised, affecting Merit’s visibility. |

Summary

Dr. Phil bankruptcy has become a significant topic in the media as his venture, Merit Street Media, faces critical financial turmoil. The television network, founded by the iconic TV personality, has filed for Chapter 11 bankruptcy protection amid ongoing legal disputes with its distribution partner, TBN. With liabilities between $100 million and $500 million and substantial personal investment from McGraw, the future of the network is uncertain. Significant operational challenges, such as technical failures and inadequate marketing support, have further exacerbated the situation, leading to layoffs and stalled programming. The outcome of this legal battle will be crucial in determining the survival of Dr. Phil’s latest media endeavor.